In today’s globalized education landscape, international schools face a major financial challenge: managing payments in multiple currencies. With families coming from diverse economic regions and campuses located in areas with unstable exchange rates or strict banking regulations, having a robust and adaptable payment management system is not just useful – it’s essential.

Why Is Effective Currency Management Essential?

Most international schools enroll students from dozens of countries. This often involves:

- Tuition and service fees paid in various currencies (USD, GBP, EUR, SGD, CNY, etc.)

- Cross-border banking operations

- Compliance with local tax laws and international financial standards

- High expectations for accuracy and simplicity from expatriate parents

Without a system adapted to this complexity, manual errors, currency losses and reconciliation difficulties are inevitable.

What are some challenges faced by institutions handling multi-currency payments?

- Exchange rate fluctuations: Rates change daily. An invoice issued in one currency may be worth significantly more or less by the time payment is made. Without dynamic management, this can lead to budget discrepancies or disputes with families.

- Multiple bank accounts: Some schools maintain separate bank accounts for each currency, complicating reconciliation and reducing financial visibility. Transfers between accounts also incur fees.

- Inconsistent invoicing: Issuing invoices in multiple currencies using different tools undermines consistency and complicates accounting traceability.

- Local payment expectations: Families expect to pay using their preferred local methods—SEPA in Europe, FPS in Hong Kong, PIX in Brazil, mobile money in Africa, etc. Managing these payment options adds regulatory and technical complexity.

- Compliance and reporting: Currency conversions must be accurately tracked for accounting, taxation, and auditing purposes. Poor management can result in penalties.

What Features to Look for in a Multi-Currency Payment System?

International schools need a digital platform that removes barriers and simplifies multi-currency operations. Here are the key features to look for:

- Dynamic currency management: The system should allow invoices to be issued in one currency and paid in another, with real-time conversion based on current exchange rates. Parents can choose their preferred currency while the school retains full control.

- Integration with multi-currency bank accounts: Choose a system that can automatically reconcile incoming payments in various currencies with the correct invoices.

- Support for local payment methods: The platform should accept a wide range of payments—credit cards, bank transfers, and local options like Boleto, PIX, FPS, and more.

- Centralized billing: All invoices—tuition, activities, transport, meals—should be generated and tracked from a single module, with clear currency display.

- Automated reconciliation and reporting: Save time with a solution that auto-matches payments to invoices, handles currency conversions, and generates accurate reports.

- Customizable family preferences: Parents should be able to set their preferred currency and payment method during enrollment for a smoother experience.

A real-world example: Multi-Currency Management with Eduka

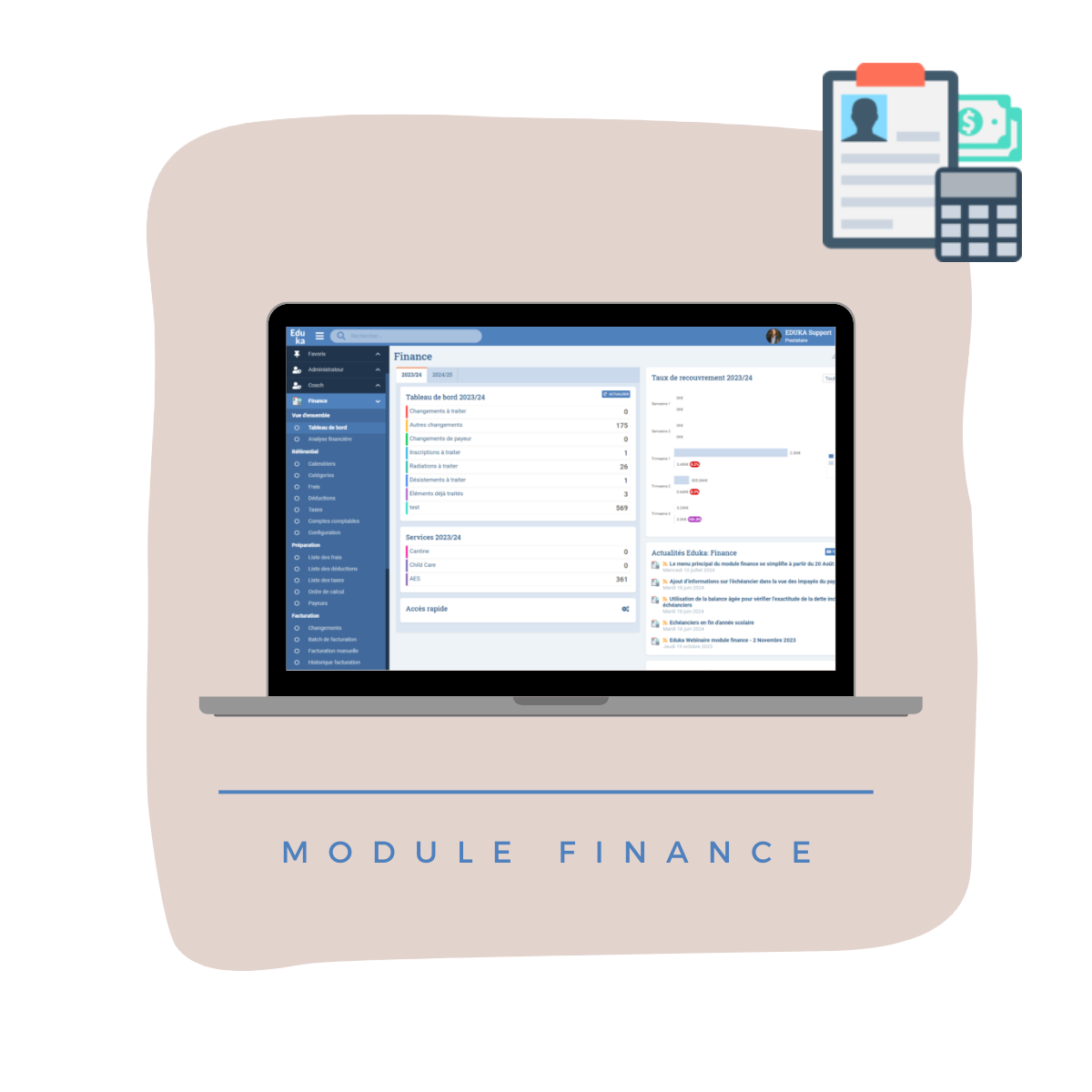

At Eduka, we understand how vital these features are. Our finance module offers:

- Comprehensive currency management for invoicing, payments, and reporting

- Integration with local payment gateways (SEPA, PIX, Boleto, credit card, etc.)

- Automatic currency conversion with daily rate updates

- Unified dashboard to track payments across all currencies

- Parent portal with currency preferences and transparent payment history

The result: fewer errors, consolidated accounting, and stronger relationships with international families.

Tips for Successfully Adopting a Multi-Currency System

- Conduct a process audit: Identify friction points related to currency handling.

- Survey families: Understand their payment expectations and habits.

- Train your staff: Even the best system is ineffective without proper onboarding.

- Ensure compliance: Choose a provider that adheres to both local and international regulations.

Conclusion

Multi-currency management is more than an administrative challenge – it’s a strategic lever impacting your school’s reputation, financial health, and parent satisfaction. By adopting the right platform, your school can offer families worldwide a seamless, transparent, and personalized payment experience.

In an increasingly global education environment, smart financial tools will be the foundation of operational excellence. It’s time to prepare for the future.

Eduka Finance Module

Optimize your school’s financial management with Eduka’s Finance module, seamlessly integrated with other platform modules and tailored to your country’s requirements.

Streamline operations with semi-automated invoicing, diverse payment methods integrated with banking systems, and simplified collections via reminders and the parent portal. Extensive reports and real-time data give you clear oversight of your financial flows.

Join hundreds of satisfied schools

Get in touch with our sales team to schedule a personalized demo, request more information, and explore how Eduka Suite can transform and elevate your school's operations.